GivingPulse

Q3 2024 Report

A holistic look at trends in giving behavior and perspectives in the U.S.

July to September 2024

Executive Summary

About the survey

Since 2022, GivingTuesday has conducted a weekly cross-sectional online survey of Americans that tracks generous actions in the past week and their associated attitudes and worldview. These findings relate to Q3 of 2024.

What we’re learning

The Q3 GivingPulse report shows how generous people can be when asked. In this quarter, we saw more people giving as rates of solicitation rise, and we saw increased engagement across in-person and online channels. Volunteerism rates were up and GivingTuesday awareness was strong, with over half of those aware saying they have a plan to participate this year. Spontaneous givers are especially ready to give if reached more effectively and recurring donors remain highly engaged across various forms of support. This momentum gives us a solid foundation to drive impactful giving as we enter the year-end season.

Key Findings

♥ In this quarter, more people recalled being asked to give, and as a result, more people are giving.

Monthly and weekly solicitation rates have rebounded after hitting a low point in Q2. 28% of people recalled being asked to give in the last 7 days.

Giving in any form and giving money remain stable compared with last quarter and last year at 61% and 33% of respondents, respectively.

Volunteering increased 10% compared with Q2 (slight increase of 5% year-over-year), up to 26% of respondents

People continue to respond to being asked at a relatively stable rate. 35% of those solicited responded with generosity, which is in line with previously reported solicitation response rates.

Spontaneous givers are just as responsive to solicitation as those who pre-plan their giving. Their behavior in Q3 suggests that they are just as, if not more, open to collective giving moments such as political giving leading up to the US election and #GivingTuesday. Spontaneous givers are the majority of all givers, and harnessing the momentum of the year-end giving season is an opportunity to engage this subset of donors.

The gap continues to close between in-person and online monetary donation methods, with the use of direct and indirect online donations increasing 10% and 17% respectively compared with Q2. In-person donation methods were particularly popular during Q4 2023. It remains to be seen if this trend will reverse during this year’s giving season

♥ GivingTuesday is creating opportunities for different kinds of givers to participate.

34% of respondents reported they were aware of GivingTuesday in the quarter that precedes it. Among those who are aware of GivingTuesday, over half reported that it inspires them to be more giving, and that half are planning to participate this year. Givers who are GivingTuesday aware, and are making a plan to participate, are also more likely to be volunteering and more likely to be giving recurring donations.

Spontaneous givers who know about GivingTuesday are also important to consider as many of them are already giving money in Q3. 63% of spontaneous, GivingTuesday-aware givers say they could afford to give more than they do.

♥ Recurring donors give in many different ways beyond money.

Recurring monetary donors are some of the most generous donors in the GivingPulse dataset: they volunteer, participate in workplace giving, give political donations, and engage with nonprofits significantly more than their non-recurring counterparts.

In Q3, recurring donors were more likely than non-recurring donors to say they could afford to give more than they do (74% vs. 52%), but they were not more likely to say they intended to give more in the future. Given their preference for planned giving, the question remains as to how recurring donors can be most effectively engaged in an ongoing manner such that they either plan to increase their giving, or decide to spontaneously “top up” their generosity.

“Generosity is thriving across communities, and trends from GivingPulse Q3 highlight once again that the social sector has an opportunity to meet donors where they are by creating multiple pathways to engagement. Even in times of uncertainty, it’s clear people want to do good for their communities. Donors, volunteers, and other supporters are integral to the health of our communities — consistently inviting them to participate is critical for driving collective support during pivotal moments like year-end campaigns and beyond.”

To get the most out of this report, don’t forget to consult our available data resources.

Part 1

Generosity-Related Behaviors

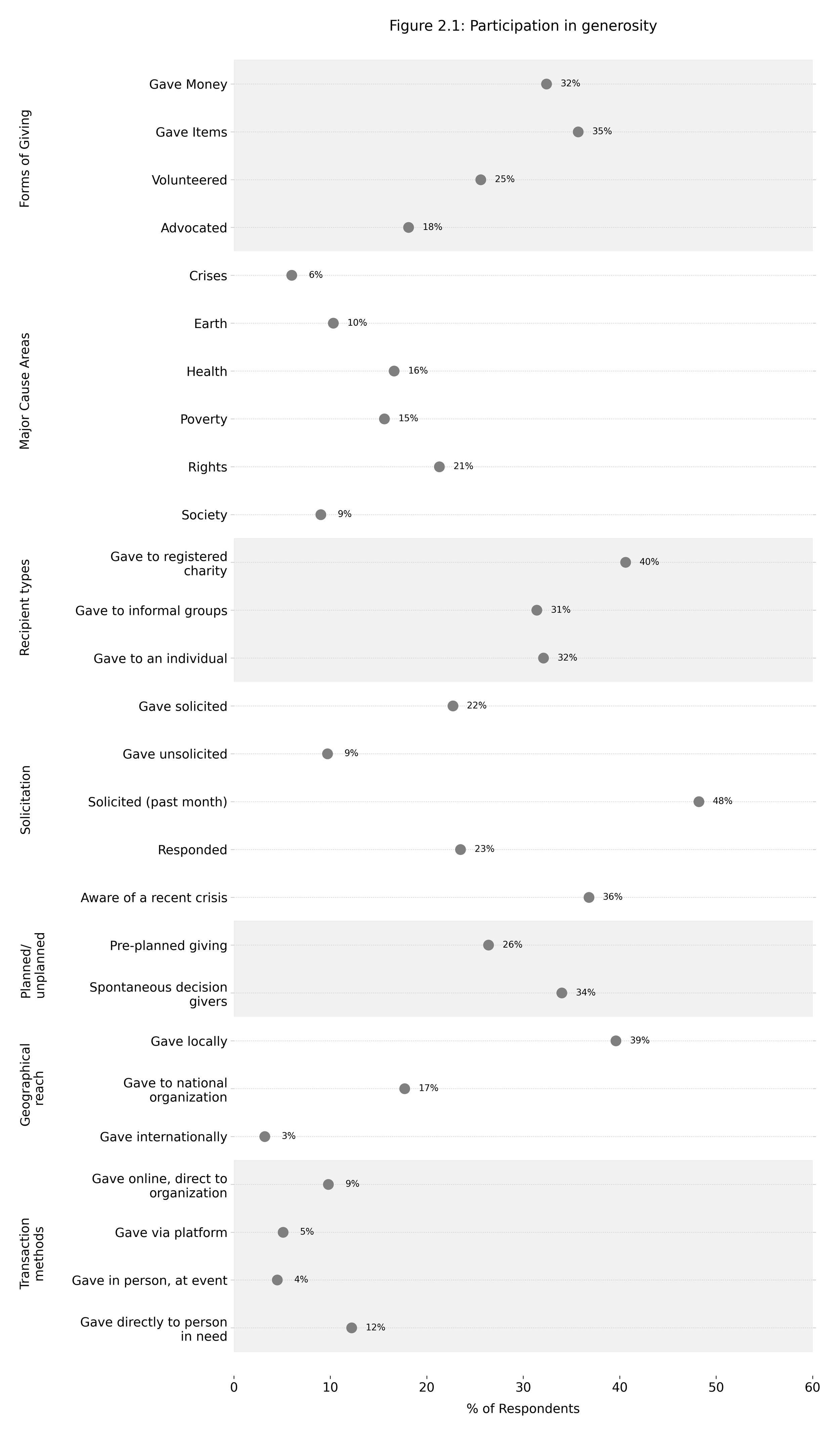

Each week, we ask 100 people across the USA what generous actions they undertook within the previous 7 days, for a combined sample of 1200 people each quarter. These actions could include giving money, time (volunteering), items, or advocating for causes or groups. We also ask people to distinguish whether they gave to a formal registered charity, an informal group, or an individual, and whether they contributed locally, nationally, or internationally.

Each of the major types of generosity are shown below on a 4-week rolling basis covering Q3 2024.

Generosity in all its forms has remained stable throughout 2024, with 60-70% of everyone having performed at least one kind of generosity within the 7 days prior to being asked. Monetary donations remain flat, and appeared to be at their lowest rate in September for all of 2024. Advocacy activity decreased more than other forms of giving. It was down 14% versus the previous quarter (Q2), and 35% versus Q3 of 2023. Specifically, advocacy on behalf of nonprofit organizations was down the most, 45% compared to Q3 of 2023.

Some other trends of note:

Volunteering up 10% QOQ, volunteering for nonprofits up 20% (+2 points)

Distribution of local, national, and international support is nearly identical to last quarter

Breakdown of giving to one or multiple recipient types is similar to last quarter, but giving to only one gift or recipient type has increased YOY (10 and 12% respectively)

When we look at combinations of generous actions, we see a yearlong trend whereby fewer people are giving both money and item donations (19% in Q1, 17% in Q2, and 14% in Q3), but more people are volunteering (6% in Q1, 7% in Q2, 9% in Q3). The overall combination of money, items and time remained unchanged – 20% of everyone does all three. Very little changed in the breakdown of types of recipients. We saw 4% more giving to both individuals and unregistered groups in Q3, compared to Q2, but it was otherwise about the same (Figure 1.3 and 1.5).

Giving by Formality

Figure 1.5 shows the distribution of support by givers to one recipient type across the other two recipient types. The breakdown here remains consistent with previous quarters, with just over half of givers to registered charities also donating informally, and around two-thirds of informal givers also donating to registered charities. In Q2, supporters of individuals were slightly more likely to support registered charities (70% in Q2) than unregistered groups (62% in Q2), but this quarter their support was distributed equally across both types indicating a slight shift towards informal giving overall.

Giving by Locality

The percentage of people giving locally, nationally, and internationally appears to be the same as in the previous quarter.

Giving by Pew Typology

Given the recent US election, we also looked at whether there were any differences in generosity trends across the 9 Pew political types in Q3. Giving patterns are quite similar, though we do see that centrist identities seem to give informally at the highest rate. These groups (Ambivalent Right, Outsider Left, Democratic Mainstays) don't identify strongly with a political party, though they tend to lean towards one or the other. They may also be less likely to care about whether or not an organization is formally registered. The Progressive Left appears to support registered charities the least of these groups, while two centrist factions (Ambivalent Right and Stressed Sideliners) support registered charities at the highest rate (76%). Volunteering is also about 20 percent more popular with some groups than others. A majority of Committed Conservatives, the Ambivalent Right, Outsider Left, and Democratic Mainstays volunteered in Q3, compared to just 25-36% of the other groups.

Part 2

Generosity Trends at a Glance

In Q3, the ways people gave were similar to the previous quarter, except that advocacy is down compared to last year (-34%) and the previous quarter (-12%). Crisis giving is down 37% compared to Q3 last year, when wildfires in Hawaii dominated headlines and crisis awareness overall was at its highest in the past five quarters, and down 21% compared to last quarter, when seasonal natural disasters attracted attention. Health and rights-focused organizations received 13% and 16% more support in Q3 versus the previous quarter.

One of the larger changes we see this quarter over last is an increase in people using the various transaction forms of giving we track. Specifically, giving via donation platforms is up 51% and direct online donations to nonprofits are up 26%. Only 5-10% of all people use one of these methods, so the smaller sample sizes can lead to more variance, but all benchmarks moved in the direction of greater online engagement and a greater proportion of people responding to solicitation compared to this time last year.

Some YOY benchmarks omitted because we asked the question slightly differently last year, leading for poor comparability

Part 3

Key Groups of Interest

Solicited and Response

In Q3, 29% of GivingPulse respondents recalled being solicited in the week prior to being surveyed and 48% recalled being solicited in the month prior. Both weekly and monthly solicitation rates saw slight increases in Q3 compared with last quarter (+10% monthly, +17% weekly) and Q3 of last year (+12% monthly, +11% weekly). Q2 solicitation rates were notably low in contrast to the preceding months, but it is promising that Q3 has seen a boost year-over-year as well. Among respondents who recalled being solicited, response rates remain unchanged compared with last quarter at 35%.

Recurring Donors

Recurring donor rates remain relatively unchanged this quarter compared with Q2 2024 and Q3 2023, after 15 months of little to no long term shifts.

We have previously looked at who recurring donors are, in terms of their demographic profile. This quarter, we take a deeper look at what other generosity behaviors recurring donors engage in.

In Q3, recurring monetary donors are more likely than non-recurring monetary donors to:

Participate in workplace giving (43% vs. 17%)

Give in other forms to registered orgs (76% vs 51% for money, 89% vs. 72% across all forms)

Plan their giving in advance instead of acting spontaneously (65% vs. 35%)

Volunteer in general (63% vs 43%) and specifically for formal nonprofits (41% vs. 17%)

Give political donations (30% vs 11%)

This behavioral profile is consistent over the past four quarters.

While recurring donors are much more likely than non-recurring donors to say they can afford to give more (74% vs. 52%), they are not necessarily more likely to report having intentions to do so. This is an interesting duality, particularly when it comes to self-reported intentions. We know that recurring donors consistently engage in the generosity ecosystem at higher rates than non-recurring givers, and we also know from Neon One that recurring donors are sticky – as of this past September, half of the donors who initiated recurring gifts on GivingTuesday 2022 were still active. These data points indicate there may be opportunities to engage with recurring donors for additional giving.

Last quarter, we observed that the composition of recipient types supported by non-recurring donors had shifted away from individuals and towards registered nonprofits. In Q3, the composition shifted back to relatively equal support between the two recipient types – 51% of non-recurring donors supporting registered nonprofits, and 52% supporting individuals. It would appear as though the shift in Q2 was reflective of the broader decrease in informal support last quarter, which has since recovered (+9% support for unstructured groups, +12% support for individuals among monetary donors).

Workplace Giving

Workplace giving saw a slight boost this quarter after a consistent decrease since Q4 2023, settling at around 10% of respondents overall (16% of givers). This represents a 12% increase in respondents from Q2, and a 15% decrease from Q3 2023.

Within this overall change, workplace giving increased about 23% among people between the ages of 30 and 50. This group is typically more likely to give in a workplace setting than other groups, but this quarter they participated in workplace giving at 2.2x the rate of those under 30 or over 50. Workplace giving also increased by over 50% among givers who make under $50K per year, hitting some of its highest levels so far this year (18-20% throughout the quarter). This represents a recovery from what was a notable low in Q2, where it appears many of these givers dropped out of workplace giving programs.

Donation Methods

Last quarter we saw that the use of online and mobile donation methods remained stable quarter-over-quarter while in-person donation methods decreased in popularity. This quarter, the gap continues to close between in-person and online donations: online direct and indirect donation methods increased in use by 10% and 17% respectively. In-person methods, on the other hand, remained relatively stable with the exception of in-store donations which dropped 14%. In-store donations were a particularly popular method in Q4 last year, and it remains to be seen whether the same trend emerges again next quarter.

Part 4

GivingTuesday, Year-End Giving, and Spontaneity

As we look towards GivingTuesday 2024 and the year-end giving season, Q3 can provide important context about how people may act during moments of collective generosity and make decisions surrounding their giving. In the GivingPulse survey, we ask respondents about whether their most recent act of generosity was pre-planned in advance or decided spontaneously “in the moment”. A pre-planned decision to give may refer to a gift that is set up in advance, like a recurring donation, or an act of generosity that is premeditated and executed at a later occasion.

In Q3 and throughout the year, spontaneous giving is consistently more popular overall. This quarter, 57% of givers reported that their most recent act of generosity was decided spontaneously, while 43% reported pre-planning, relatively unchanged compared with the previous quarter. Looking at trends over the past year, spontaneous giving was consistently prominent throughout Q4 2023 and Q1 2024, at 61% of overall giving in Q4. Near the end of this past quarter we again observe an uptick in spontaneous giving heading into Q4.

Looking more specifically towards GivingTuesday 2024, 34% of respondents reported that they were aware of GivingTuesday this past quarter. Over half of those aware of the event reported that it inspires them to be more giving, and that they had participated or planned to participate in at least one way. One difference that stands out about GivingTuesday-aware respondents in Q3 is that they are much more likely to have pre-planned their most recent generosity in advance, as opposed to deciding spontaneously – 49% of those aware of GivingTuesday reported pre-planning, compared with 40% of those unaware of GivingTuesday.

Pre-planned givers are more likely to engage multiple ways and more intensely (i.e. donating higher dollar values) when they give. Compared with spontaneous givers, pre-planned givers are:

More likely to give to registered nonprofit organizations (75% vs. 62%)

More likely to give recurring donations (24% vs. 10% of givers)

More likely to be volunteers (26% vs. 14%), either by identity or actual recent participation

More likely to support religious causes (31% vs. 15%)

More likely to support rights-based causes (45% vs. 27%)

Pre-planned givers make up an integral part of the nonprofit ecosystem, and a large subset of potential GivingTuesday and year-end givers. But many people are not thinking about GivingTuesday quite yet, and may or may not have considered their year-end giving plan beyond that. Given the popularity of spontaneous decision making around year-end 2023, it is important to consider what the behavior of this subgroup might look like in the coming months.

When we look at spontaneous givers who were aware of GivingTuesday in Q3, they were more likely than those who were unaware to:

Give money to registered nonprofits (30% vs. 20%)

Give to a political campaign or figure (19% vs. 7%)

Be a recurring donor (19% vs. 6%)

Initiate a generous movement or initiative (23% vs. 6%)

Say they could afford to give more than they do (63% vs. 41%)

That is to say, a significant portion of recent spontaneous generosity was exhibited by those who are aware of GivingTuesday. This does not mean that these people were motivated directly by GivingTuesday, since these activities occurred during Q3. This relationship could also imply that the people who were already doing these things more often tended to be attracted to GivingTuesday, or at least more "plugged in," and therefore more aware of the event. Regardless, there is still a significant relationship between generosity and GivingTuesday awareness beyond just the day.

There are also behaviors that do not differ between pre-planned and spontaneous givers. Among solicited givers generally speaking, there was no significant difference in response rate between those who give spontaneously and those who pre-planned their recent giving this quarter. And in the lead up to the US election, spontaneous givers in Q3 were approximately equally likely to give to political causes as pre-planned givers (11% vs. 13%), showing that they were just as mobilized during this moment of collective civic participation.

While pre-planners may remain the typical targets of nonprofit engagement, there is strong evidence to suggest that those who decide to give in the moment can and will rise to the occasion when the opportunity to give presents itself. GivingTuesday and the end-of-year giving season is one such opportunity.

Additionally, planning to give on or participate in GivingTuesday does not preclude one from choosing to give later as well. Givers who make a plan do not necessarily plan all of their giving. In fact, Neon One reports that the vast majority of donors (about 80% of in 2023) who initiate a recurring monthly gift on GivingTuesday make another donation to the same organization before the end of the year. We know from Section 3 that recurring donors give back in a multitude of other ways beyond just their recurring donations, and are an example of a type of giver that have capacity to give more if targeted with the correct prompt.

At present, we don’t know how the GivingTuesday to year-end period will look this year, but if there is a repeat of the sustained spontaneous giving behavior that we had last year, then this could be a prime period for harnessing that energy amongst potential and existing donors.

Part 5

How World Events and Crises Affect Giving

Crisis and Awareness

We ask respondents if they were aware of any recent crises or world events, and if so, that actions they took to respond with generosity. With natural disasters from Summer having left the news cycle, no singular crisis or event captured widespread attention in Q3, 2024.

Overall crisis awareness reached its lowest point in 2024 in the first half of September

Most dominant crisis was Hurricane Beryl and Hurricane Helene right at the end of the quarter, also subsequent flooding

Other crises mentioned include remnants of tornado season and the assassination attempts made on President Donald Trump

Of those identifying a crisis, the percentage of people who either ignored, intended to respond, or had already responded with generosity was exactly the same as the previous quarter. Looking further back in time, we saw a slight increase in those intending to respond, and a corresponding decrease if those who said they ignored it, compared to the current quarter.